Why Payments Matter: More than Just Transactions

- Revenue Generation: Payments generate substantial revenue through transaction fees, interchange fees, and value-added services. By actively managing and optimizing their payment offerings, banks can tap into this lucrative revenue stream.

- Customer Engagement and Retention: Payments provide a frequent touchpoint with customers, offering valuable insights into their spending habits and preferences. Banks can leverage this data to personalize offerings, enhance customer experiences, and foster long-term loyalty.

- Competitive Differentiation: In an increasingly crowded market, offering innovative and convenient payment solutions can differentiate banks from the competition and attract new customers.

- Data-Driven Innovation: Payment data can be a goldmine for innovation. By analyzing transaction patterns, banks can identify new opportunities, develop targeted products, and stay ahead of evolving customer needs.

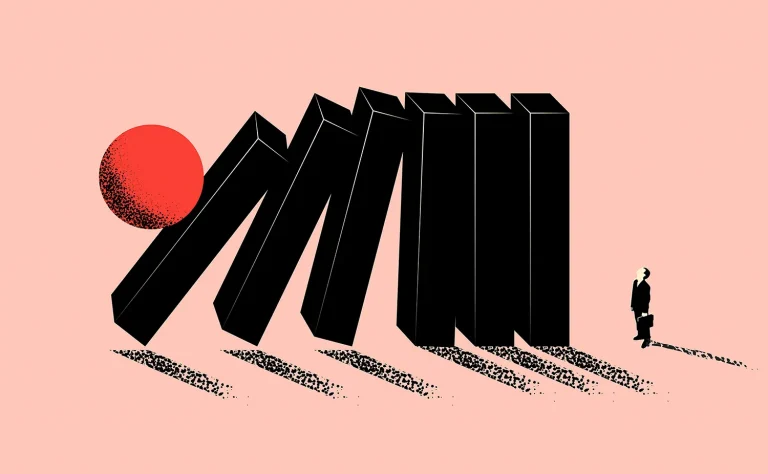

The Changing Payments Landscape

- Rise of Digital Payments: The proliferation of smartphones and digital wallets has accelerated the shift towards digital payments, making traditional payment methods less relevant.

- Emergence of Fintechs: Fintech companies are disrupting the payments industry with agile solutions and customer-centric approaches, challenging traditional banking models.

- Evolving Customer Expectations: Customers now demand seamless, secure, and personalized payment experiences across various channels and devices.

How Banks Can Treat Payments as a Business

Develop a Customer-Centric Approach: Understand your customers’ payment preferences and pain points, and design solutions that meet their evolving needs.

Invest in Technology and Innovation: Stay ahead of the curve by adopting new technologies and collaborating with fintech partners to offer cutting-edge payment solutions.

Leverage Data Analytics: Utilize payment data to gain insights into customer behavior, identify new opportunities, and personalize offerings.

Prioritize Security and Fraud Prevention: Invest in robust security measures to protect customer data and maintain trust.

Build a Strong Payments Ecosystem: Foster partnerships with merchants, payment processors, and other players in the payments ecosystem to offer a seamless and comprehensive payment experience.